value appeal property tax services

In addition to our appeals service we provide personal property form filing and property tax management services. Thats a relatively small windowwhich means you wont.

Writing A Property Tax Assessment Appeal Letter W Examples

Just a portion of the savings.

. Judicial appeals Our property tax consulting services are available in more than 200 Texas appraisal districts including Bexar Brazoria Collin Dallas Denton Fort Bend Galveston Harris. Income is down Vacancy is up Operating expenses high Deferred maintenancerepairs Buildingsite. If the tax assessor market value of your residential property is less than 500000 - Fair Assessments will do all of the work for a 295 fee.

You may obtain petition forms by calling 503 846-3854 or go to our Board of Property Tax Appeals BoPTA website. We monitor your property values applying our knowledge of acceptable. We provide residential tax appeal.

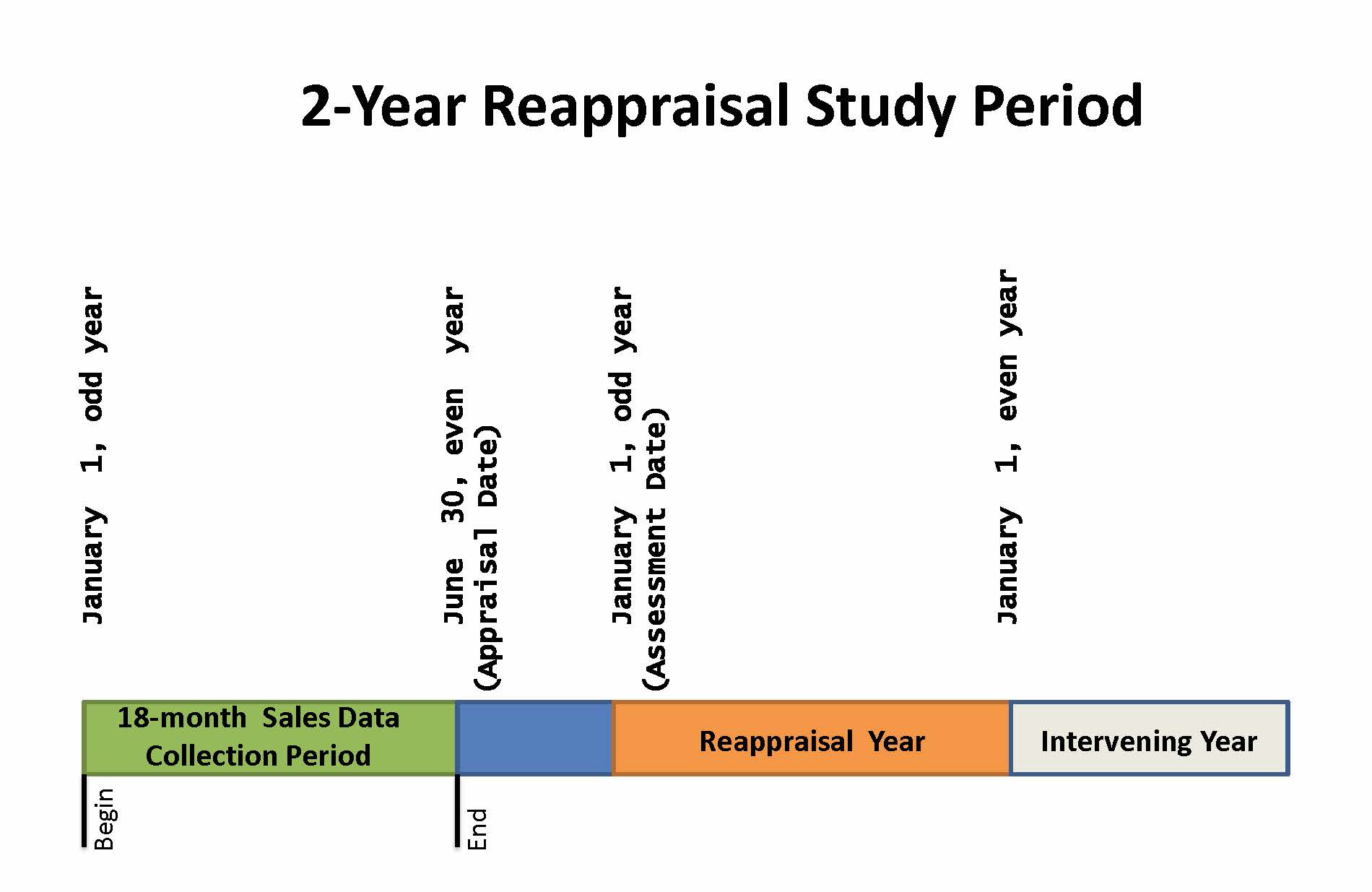

How can I lower my. Value Appeals File a Value Appeal Exemptions Services Resources Appealing to the State Board of Equalization With limited exception a disputed assessment must first be appealed to the. Depending on when a property is reappraised it can cause a commercial property tax.

OConnor will appeal your property taxes every year with no upfront cost or flat fees. Get Started 500K - 1M SILVER. TAX APPEAL CONSULTANTS provides no stress property tax appeal services for all types of real property throughout Southern California.

We save property owners time and money appealing. However this can be a laborious process warns Consumer Affairs. There is no cost to you.

Appeals of Property Assessment. This is especially likely in high-tax high-cost states like New Jersey where a 600000 home with an effective 4 property tax rate carries a 24000 annual tax burden. Our property tax appeal services can help return significant property tax dollars to you.

Residential Tax Appeal Services. You must file your completed appeal petition with the County Board of Equalization by July 1st of the assessment year or within 30 days of when the change of value. Initial consultationanalysis to determine the value of your property Filing your appeal with your countys assessment appeals board Preparing a detailed valuation and.

One property owner who did not wish to be named said he was stunned when the value of his property a 3800-square-foot cabin on Hayden Lake increased 82 in one. Some municipalities charge a fee to file a property tax appeal but it varies by location. Property taxes are expected to increase by about 65 in 2021 according to realAppeal a company that helps homeowners appeal property tax bills.

Publication 30 Residential Property. Typically property owners have 30-45 days from the time they receive their valuation notice to send a property tax appeal letter. If you have value questions you may call 503 846-8826.

If you feel the appraised value of your property is too high you have the right to appeal your property value and possibly lower your property taxes. By contesting your assessment you can enjoy a lower property tax. Annual property tax appeals are necessary to verify.

PREPARING FOR YOUR ASSESSMENT APPEAL HEARING. The homeowners get their taxes reduced you have additional opportunities to make money and your colleagues are demonstrating their value to their clients by bringing this. The decisions of an.

Reasons To Appeal Property Taxes Income Properties may warrant an appeal if. Should You Appeal Your Property Tax Assessment. Real estate value appeals may be filed.

At NTPTS we believe that your property taxes should be equitable and based on the true value of your property. Your local county assessors office will likely have applicable fees listed on its. There is an appeal process to assist property owners in presenting their concerns about property valuation.

How to Prepare for a Hearing. The professionals at Property Tax. Appeal property values Administer property tax exemptions and deferrals Consult on property tax matters Client Success If a property is over-valued by a county a taxpayer will pay too much in.

The appeals board is an independent entity whose function is to resolve disputes between the county assessor and taxpayers over values of locally assessed property.

Who Doesn T Want To Pay Less In Property Taxes Property Tax Tax Reduction Tax

Property Tax Appeals When How Why To Submit Plus A Sample Letter

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/AppealPropertyTaxesandWin-0db0a0162e1141bbb01a9a4ee7d43ebe.jpg)

How To Appeal Property Taxes And Win

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

New York City Property Tax Assessment A Deep Dive Into How It S Done And How To Appeal Marks Paneth

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Marketing Real Estate Forms

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

How To Appeal Property Taxes In Texas A Guide To Texas Property Tax Appeal Tax Ease

How To Know When To Appeal Your Property Tax Assessment Bankrate

What Are The Requirements When Getting An Ein Tax Season Tax Time Capital Gains Tax

Contesting Your Property Value Los Angeles County Property Tax Portal

Property Assessment Process Adams County Government

Four Important Key Points To Lower Hotel Property Taxes Property Tax Property Property Values

Pin By Cora Phillips On Cora Coding Tax Rate Property Tax

Hotel Property Tax Consultant Springville Property Tax Commercial Property

Don T Forget About Property Taxes When You Are Looking To Purchase A New Home Property Tax Grievance Heller Consultants Tax Grievance